Within the asset allocation approved by the Investment Committee, the Endowment portfolio is invested in a broadly diversified range of strategies managed by external investment firms around the globe. The Investment Committee has delegated authority to senior investment staff to evaluate, conduct due diligence on, and appoint these managers. Each manager has deep expertise in their respective area and operates with the highest standards of integrity and transparency. Investment managers exercise discretion over their mandates in accordance with specified investment guidelines.

UK Endowment

UK Endowment at a Glance

The University of Kentucky Endowment ($2.48 Billion as of June 30, 2025) is an aggregation of funds comprised of gifts from donors and grants from the Commonwealth of Kentucky with the requirement that they be invested in perpetuity to generate a reliable and steadily growing revenue stream to support the mission of the University now and in the future. The revenue stream supports scholarships, chairs, professorships, basic research, as well as academic and public service programs, as defined by the individual endowment agreements. The Endowment is expected to provide fiscal stability since the principal is invested for long-term growth and total return spending distributions are generated year after year.

Investment Committee Board of Trustees

Endowment Investment Policy

Financial and Investment Objectives

1. Intergenerational Equity

To preserve the long-term purchasing power of the Endowment assets and the related revenue stream over time to evenly allocate support between current and future beneficiaries (intergenerational equity).

2. 7.5% Annual Return

To earn an average annual return, after expenses, of at least 7.5% per year over full economic market cycles.

Asset Allocation

Diversification of investments among assets that are not similarly affected by economic, political, or social developments is highly desirable. The general policy shall be to diversify investments so as to provide a balance that will enhance total return, while avoiding undue risk concentrations in any single asset or investment category. To ensure broad diversification, the asset allocation will be set with the following target percentages and within the following ranges:

| Asset Class | Target | Range |

|---|---|---|

| GLOBAL EQUITY | 64% | 40-75% |

| Public Equity | 40% | |

| Private Equity | 24% | |

| GLOBAL FIXED INCOME | 12% | 5-25% |

| Public Fixed Income | 10% | |

| Private Credit | 2% | |

| REAL ASSETS | 12% | 5-20% |

| Public Real Assets | 3% | |

| Private Real Assets | 9% | |

| DIVERSIFYING STRATEGIES | 12% | 5-20% |

Note: Sub-asset category (e.g., Public Equity) figures reflect working targets. Investment staff has flexibility to adjust sub-asset category exposures within broader, asset category (e.g., Global Equity) ranges, based on market conditions and ongoing research.

Investment Strategies

Investment Managers

For investment managers interested in contacting the University of Kentucky Investment Office about their strategies, please send us an email through the below:

UK Endowment Investments

Access the complete listing of the UK Endowment investments below for a comprehensive look at each manager and the corresponding market values across the portfolio:

Performance and Asset Growth

Endowment Performance

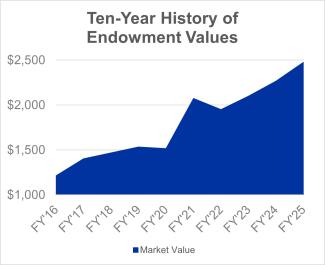

Historical Endowment Values

*The Endowment was incepted July 1, 1992

**The policy benchmark is a weighted average of various market index returns that are representative of the University's asset allocation. The benchmark has changed over time due to changes in the University's asset allocation, and was most recently updated effective January 1, 2026. Component weights of the policy benchmark are included below:

40% MSCI All Country World IMI Index (ACWI IMI)

24% Cambridge Associates (CA) Private Equity and Venture Capital indices [1] [2]

10% Barclays Aggregate Bond Index

2% CA Private Credit Index [1] [3]

3% Blend of 33% Bloomberg Barclays U.S. TIPS Index / 33% NAREIT Index / 33% Alerian Midstream Energy Index

5% CA Natural Resources & Infrastructure indices [1]

4% CA Private Real Estate Index [1]

12% Blend of 75% Bloomberg Short-Term Gov’t/Corp Index / 25% MSCI All Country World IMI Index (ACWI IMI)

[1] Cambridge Associates Private Benchmarks will be weighted based on the actual exposures of the underlying private investment asset classes for each respective allocation.

[2] PE / VC Indices contain the following sub-asset classes: Buyouts, Growth Equity, Venture Capital, and Distressed Securities (Credit Opportunities / Control Oriented Distressed).

[3] Private Credit indices contain the following sub-asset classes: Credit Opportunities, Subordinated Capital, and Senior Debt.

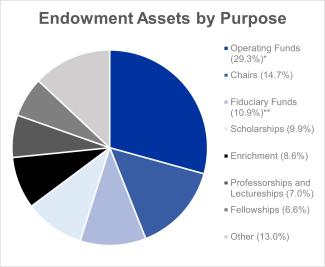

Breakdown of Total Endowment Assets

As of June 30, 2025

*Operating Funds include $474M Hospital quasi endowment and $262M University Operating quasi endowment

**Fiduciary Funds include $272M Other Post-Employment Benefits (OPEB) quasi endowment

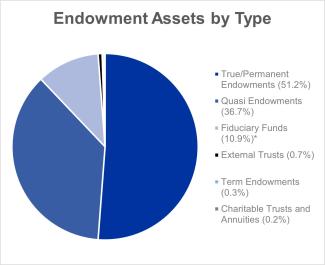

As of June 30, 2025

*Fiduciary Funds include $272M Other Post-Employment Benefits (OPEB) quasi endowment

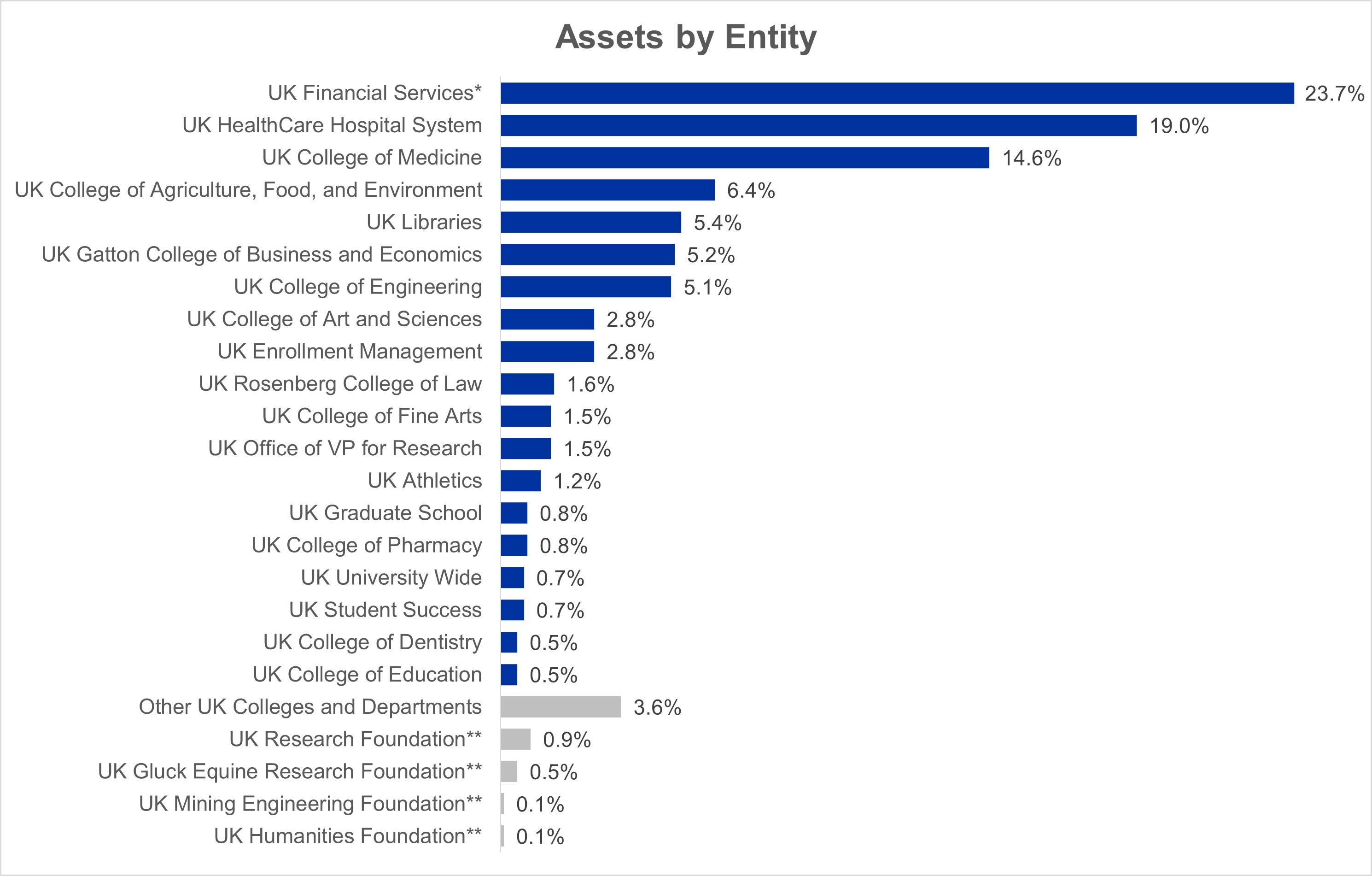

As of June 30, 2025

*UK Financial Services includes $272M Other Post-Employment Benefits (OPEB) quasi endowment, $262M University Operating quasi endowment, $28M Medical Malpractice quasi endowment, and other endowments administered by UK Financial Services

**Affiliated corporation

Meet Our Team

| Todd Shupp , CFA | Chief Investment Officer |

| Nancy Rohde, CFA | Investment Director |

| Connor McKee, CFA | Investment Analyst |

| Kristina Goins | Operations Manager |

Endowment Internship Program

The Investment Office offers paid part-time internships to University of Kentucky undergraduate students. Explore additional information on the program, including application guidance and perspective from former interns below:

Find Us

The Investment Office is located in suite 310 of the Peterson Service Building on the University of Kentucky’s Lexington campus. The address is 411 South Limestone, Lexington, Kentucky 40508.

For parking needs, the Cornerstone Garage is located just north of the Peterson Service Building. From the Cornerstone Garage, there are two pedestrian bridges at the third level. One connects from the third floor of the garage to the second floor of the Peterson Service Building. The other crosses South Limestone Street and connects to the main campus.